Federal Reserve Lowers Fed Funds Rate Twice on Coronavirus Fears

The Impact of Fear on Economic Activity

When people are fearful they tend to cut back on consumption outside of fear-based purchases like toilet paper, cleaning supplies, face masks, guns and gold. If the fear is widespread enough financial asset prices can sell off, further boosting fear, leading to a doom loop cycle where the financial abstractions of the economy lead the real economy lower as the opposite of the wealth effect takes place.

How Big is Travel?

Travel and hospitality account for about 15% of the domestic economy. Many other businesses like bars & restaurants are shut down or only allow to-go orders.

The United States has run a large and growing goods trade deficit with China for decades. Chinese students attending universities and Chinese tourism have been strong services exports for the United States. Airplanes manufactured by Boeing are also a large export.

The Federal Reserve Fights Back

The Federal Reserve has moved to try to offset some of the adverse impacts of COVID-19.

- On March 3, 2020 the Federal Reserve Open Market Committee (FOMC) lowered rates from 1.75% to between 1% to 1.25%.

- Last Sunday the Federal Reserve slashed the federal funds rate by a percent down to 0.00% to 0.25%, making their March 15 cut the second emergency rate cut in 13 days.

- On Sunday the Federal Reserve also announced $700 billion worth of quantitative easing, with $500 billion going toward Treasurys and $200 billion going toward mortgage-backed securities.

The goal of these moves is to lower the hurdle rate for investments while lowering the carrying cost of debt for companies and flooding the market with liquidity to offset forced position liquidations caused by the crisis.

Does the Federal Reserve Control Mortgage Rates?

The Federal Reserve controls the short end of the yield curve, but the longer end of the yield curve has been falling throughout the year as well on coronavirus-driven recession fears.

The longer end of the curve is controlled in part by inflation expectations along with factors like liquidity and the balance of fear versus greed in the capital markets.

- If investors perceive risk to be low they generally prefer to invest in higher returning equities over lower returning bonds.

- If investors perceive risk to be high they prefer shorter-duration high-quality liquid bonds to more speculative equities.

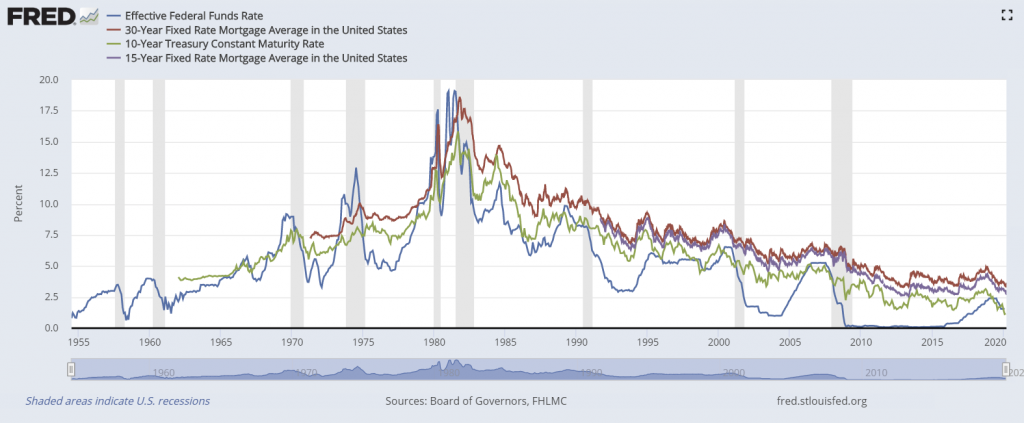

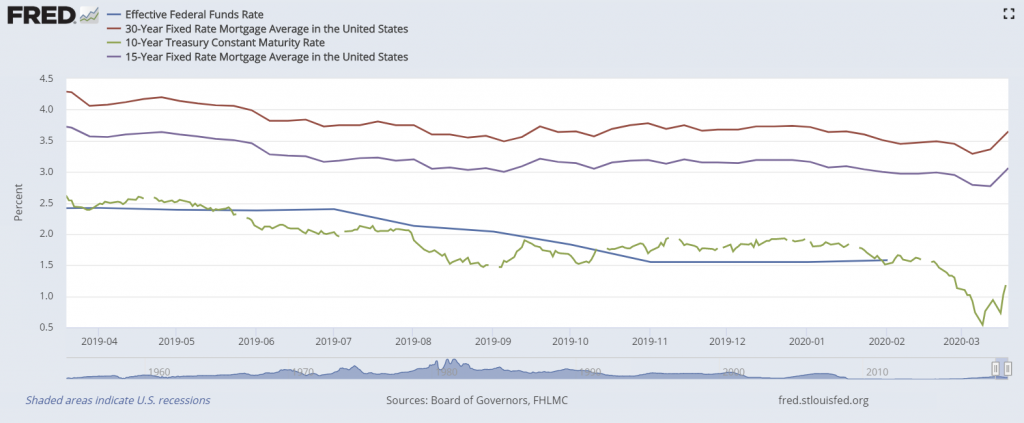

The 30-year fixed rate mortgage tends to track the 10-year Treasury at a slightly higher yield. The following FRED graph shows how both the 15-year & 30-year fixed-rate mortgage rates closely track the 10-year Treasury versus the Fed Funds rate.

In spite of loans being offered for 30 years, many people move homes or refinance their loans roughly every 7 to 12 years, making the 10-year a better duration match for the typical mortgage than the 30-year Treasury Bond.

Zooming in more closely on the graph you can see how in recent weeks as government stimulus measures worked their way through Congress both the 10-year and mortgage rates shot up, even as the FOMC dropped the Fed Funds rate to 0.0% to 0.25%.

Increased fiscal stimulus lowers the risk of a deep recession & increases inflation expectations, this can in turn cause bonds to sell off, boosting their yields.

| Rate Type | 1-9-20 | 3-5-20 | 3-19-20 |

|---|---|---|---|

| Fed Funds Rate | 1.75% | 1-1.25% | 0-0.25% |

| 10-Year Treasury | 1.85% | 0.92% | 1.18%* |

| 15-Year Fixed Mortgage | 3.07% | 2.79% | 3.06% |

| 15 MRT vs 10 yr Treas. | +1.22% | +1.87% | +1.88% |

| 30-Year Fixed Mortgage | 3.64% | 3.29% | 3.65% |

| 30 MRT vs 10 yr Treas. | +1.79% | +2.38% | +2.47% |

*data from 3-18-20

As shown in the table above, mortgages trade at around 1.5% to 2.5% higher yields than the 10-year Treasury. Purchasing mortgage-backed securities should tighten this spread by driving down the yields on MBS, which should lower interest rates on mortgages.

This process has pipeline effects which take time to work their way through the economy. At the end of April Freddie Mac’s data showed the 30-year reached a record low of 3.23% and the 15-year dropped to 2.77%.

While there are multiple related layers of uncertainty and volatility in the market, rates may decouple from the 10-year:

Uncertainty surrounding the coronavirus outbreak has bred volatility in mortgage rates. The usual indicators of where rates are headed — namely the yield on the 10-year Treasury — are no longer reliable predictors. Instead, what is having a greater effect on mortgage rates is the capacity of lenders to handle the huge volume of refinances brought on by lower rates and the increasing amount of mortgage-backed securities the Federal Reserve is buying.

How do Homeowners React to FOMC Rate Moves?

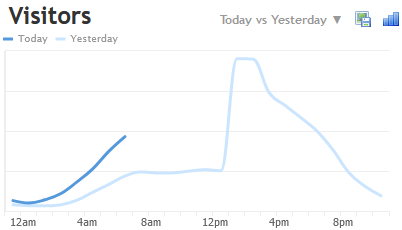

Over the years numerous surveys have shown roughly a quarter to a third of homeowners do not know what their mortgage rate is. While many homeowners do not know what their rate is, Federal Reserve moves are widely covered in the news. This leads to a surge in consumer demand. The following picture shows traffic to this website. The light blue line shows a huge spike on a Sunday after the Federal Reserve announcement.

People who are consumed by fear or worried they may lose their job will be less likely to take on large sums of debt or make bit life choice changes, thus when there is major volatility and uncertainty people are less likely to buy a home using credit. Roughly 88% of residential homes purchased by homeowners are purchased using financing.

Those who already own homes see news of decline in market rates and quickly check to see how much money they can save. As of the end of March the MBA recently stated that refinance volume has increased in share to where it now represents 75.9% of total mortgage applications.

How is the Mortgage Market Structured?

Individual home loans created by lenders can be held in their company portfolio or can be sold off into the secondary market. Before selling loans off into the secondary market lenders group them into a mortgage-backed security.

Government sponsored entities (GSEs) Fannie Mae and Freddie Mac guarantee MBS which contain conventional mortgages. The Department of Veterans Affairs guarantees VA loans while the USDA guarantees some rural loans and the FHA helps lower risk on some loans issued to low-income homeowners and other groups.

Historically most of the mortgage loan origination market has been dominated by large banks like Wells Fargo, Citigroup, Bank of America, U.S. Bank, and J.P. Morgan Chase. Due in part to regulations enacted after the Great Recession in recent years banks originated around half of home loans while the other half of home loans are originated by firms specializing in mortgage loans like Quicken Loans, PennyMac, Caliber, United Wholesale, Amerihome, loanDepot and Freedom Mortgage.

More recently the nonbank lenders have represented 66% of loan originations according to the Urban Institute. This is a jump from 40% in 2013.

When the mortgage market was dominated by large financial institutions they could easily pull employees across from other departments to service shifts in consumer demand. The streamlined mortgage-focused companies do not have the spare capacity which is created by being part of a larger organization. This means when rates drop the spike in consumer demand causes many lenders to pull back on their marketing spend and rework their existing book of loans to try to get prior borrowers to refinance.

In some cases this means a lender which is at capacity might pause their ad spend and/or lift their advertised rate shown on third party mortgage rate tables to try to discourage incremental consumer demand until the firm is able to hire more employees or the spike in demand dissipates.

On March 6th, Quicken Loans CEO Jay Farner stated:

In the last week, we’ve probably had three record days. Yesterday was, again, a new record for mortgage applications. It really is one of those once-in-a-lifetime opportunities. I’m not certain we’ll see rates like this again.

The conventional loan market still remains robust due to the backing of the GSEs and the United States Federal Government. That being said, the jumbo mortgage market does not have this backing & is much more likely to see volatility. Wells Fargo was the biggest originator of jumbo loans in 2019. They announced they would stop purchasing jumbo loans made by third-party mortgage bankers and they would only refinance existing jumbo loans for customers who hold at least $250,000 in liquid assets with the bank.

Further, some investment firms facing investor redemptions as equities slide are becoming forced sellers of bonds including mortgage bonds and other commercial mortgage paper tied to real estate investment trust (REITs).

“Real estate billionaire Tom Barrack said the U.S. commercial-mortgage market is on the brink of collapse and predicted a “domino effect” of catastrophic economic consequences if banks and government don’t take prompt action to keep borrowers from defaulting. … Specifically, his paper highlights the fragility of mortgage real estate investment trusts, or REITs, and credit funds and the lenders that provide them with liquidity via repurchase financing.”

The standard vanilla mortgage market has many piecemeal regulations and supports coming together to offer homeowners relief.

- Fannie Mae & Freddie Mac suspended foreclosures for 60 days.

- FHFA director Mark Calabria is promoting loan forebearance programs which will not hit consumer credit scores as long as homeowners experiencing hardship contact their loan servicer and stick to the terms of the program. He stated GSEs should be fine so long as the crisis lasts 6 to 8 weeks, but suggested backing from the Federal Reserve or Congress would be needed if the crisis lasts significantly longer than that.

- New York Governor Andrew Cuomo issued an executive order urging banks to postpone mortgage payments for 90 days for financially distressed homeowners.

- The mortgage REIT market began seizing up with many REITs suspending dividends and MFA Financial failing to meet a margin call on March 23, 2020. The Federal Reserve announced unlimited QE. The Federal Reserve Bank of New York will buy $50 billion of agency mortgage-backed securities each business day from March 23rd to March 27th.

- Ginnie Mae is providing lender support: “In a statement late Friday, Ginnie said it would help get cash to companies such as Quicken Loans Inc. and Mr. Cooper Group Inc. that expect a wave of missed payments as borrowers lose jobs and income from widespread closures of nonessential businesses, cancellations of public events and orders for people to stay home if possible.”

- The Federal Reserve is likely to step in offering emergency loans to offset missed payments from workers who are laid off. There is no reason to suspect they would do all the above mentioned interventions while skipping this step in the chain. If they do not intervene, many mortgage servicers are likely to go under due to mandatory MBS payments they are obligated to pay while many homeowners are deferring loan payments. Even the much less populous country of Canada has a half-million mortgage deferral requests while many homeowners in the US have been unable to contact their mortgage servicers as phone lines were busy and calls went unanswered.

- On April 23 Treasury Secretary Steven Mnuchin stated nonbank mortgage servicers did not currently provided the level of systemic risk which would justify the creation of a Fed facility

- Some mortgage industry professionals are pushing to increase conforming loan limits to add liquidity to the upper end of the residential housing market.

Mortgage Deferral versus Mortgage Forbearance

Mortgage Deferral

Mortgage deferrals may allow the homebuyer to make a few additional payments at the end of their mortgage payment period or make a slightly larger monthly payment until they catch up with their original amortization schedule. If you miss 3 months it could add 3 monthly payments to the end of your original loan term, or you could pay a couple hundred extra dollars per month with your regular monthly payment.

Mortgage Forbearance

Mortgage forbearance is simply the suspension of foreclosure. This means if you receive a forbearance for 6 months then when that 6 month period has ended you will end up needing to make your traditional monthly payment on the 7th month AND pay for 6 monthly payments you missed at the same time in a lump sum. If your monthly mortgage payment is $2,000 per month then if you have 6 months forbearance you will end up having to make a $14,000 payment in 7 months.

Hundreds of thousands of Americans are already using forbearance:

For the week of March 23 through March 29, caller requests numbered 218,718. That number jumped to 717,577 requests in the following week, according to a Mortgage Bankers Association calculation. Mortgage servicers are required to grant forbearance to any borrower who requests it with no documentation of hardship necessary.

Millions of Americans are expected to tap mortgage forbearance programs. The FHFA’s Mark Calabria estimated 2 million borrowers would seek forbearance while the Urban Institute’s Laurie Goldman suggested a worst-case scenario could see 12 million Americans tap forbearance programs.

By April 15th the low estimate has already been surpassed. Black Knight data showed that more than 2.9 million homeowners (5.5% of those with an active mortgage) are already in forbearance programs.

On April 24th Bloomberg reported Black Knight data showed homeowners seeking to delay mortgage payments increased 17% over the past week to 3.4 million. About 6.4% of borrowers with an active mortgage entered into forbearance programs, up from 2.9 million or 5.5% a week earlier.

Further breaking down the above statistics,

- around 5.6% of the 27.9 million borrowers with loans backed by Fannie Mae & Freddie Mac missed payments

- around 8.9% of the 12.1 million borrowers with loans backed by Ginnie Mae missed payments

- around 5.7% of the 12.9 million mortgages not backed by any government program were in forbearance

The MBA estimated 4 million homeowners were in forbearance programs on May 3, bringing the total up to 7.91% from 7.54% the prior week. These stats were broken down as follows:

- Ginnie Mae – rose week over week from 10.45% to 10.96%

- Fannie Mae & Freddie Mac rose from 5.85% to 6.08%

- private label security and portfolio loans rose from 8.3% to 8.88%

- depository servicers rose from 8.41% to 8.75%

- independent mortgage banks rose from 7.13% to 7.54%

These numbers are up massively off the baseline as only 0.25% of loans were in forbearance on the week of March 2.

The Mortgage Bankers Association reported that at the end of the week of October 11th mortgages in forbearance plans fell to 5.92% of outstanding loans.

Consumers who obtained a 6-month forbearance could renew it for another 6 months, though renewing it requires contacting their loan servicer and requesting renewal.

We have published an in-depth guide covering mortgage deferral and forbearance programs.

When is the Best Time to Refinance?

Mortgage rates recently reached all-time lows, though they may go even lower after the Federal Reserve rate cut news becomes old news and consumers are not overwhelming lenders.

When the Federal Reserve lowers the Fed Funds rate sometimes the associated spike in consumer demand causes lenders to wait a while before lowering their mortgage rates.

An analogy which helps explain the above if when a war breaks out in the Middle East or something disrupts oil flow local gas stations almost immediately raise fuel prices & when oil prices fall gas stations tend to be slower to follow the move down.

Some lenders who have struggled to keep up have been raising rates. MarketWatch reported the recent weekly mortgage rate increase was the largest since November 2016.

There are many counteracting trends and forces driving rate shifts.

- Fear of financial collapse causing capital to leave the stock market and rotate into bonds and money market accounts as stocks sell off.

- Central bank stimulus lowering the risk of financial contagion by putting a bid under both stocks and bonds. In the short run as financial stability is improved and fear subsides this should drive long duration interest rates higher.

- Fiscal stimulus spends money into the economy to support the economy and raise inflation expectations. If both branches of Congress and the presidency go to the same political party 2021 will likely see a massive fiscal stimulus program. This would increase longer duration interest rates.

- Nonbank lenders have a wave of refinance demand from central bank intervention which they do not have adequate staff to handle. This has caused them to hold back on lowering rates as much as they could have and pull back on advertising until they staff up.

- Over time consumer demand will diminish when rates stop falling. Lenders who have increased hiring will see supply and demand come more in balance.

- Layoffs associated with the economic slowdown might make banks want to tighten credit standards to ensure they are lending to borrowers who are not likely to get laid off and default if the economy continues slowing.

- The work from home movement should create massive waves of innovation as well as new company structures as more businesses move online.

Nobody knows what the rates will be tomorrow or next week. If they had certainty on that they could make a lot of money. Recent market volatility has reached record levels with the DJIA increasing or decreasing by 4% a day for 8 consecutive trading days.

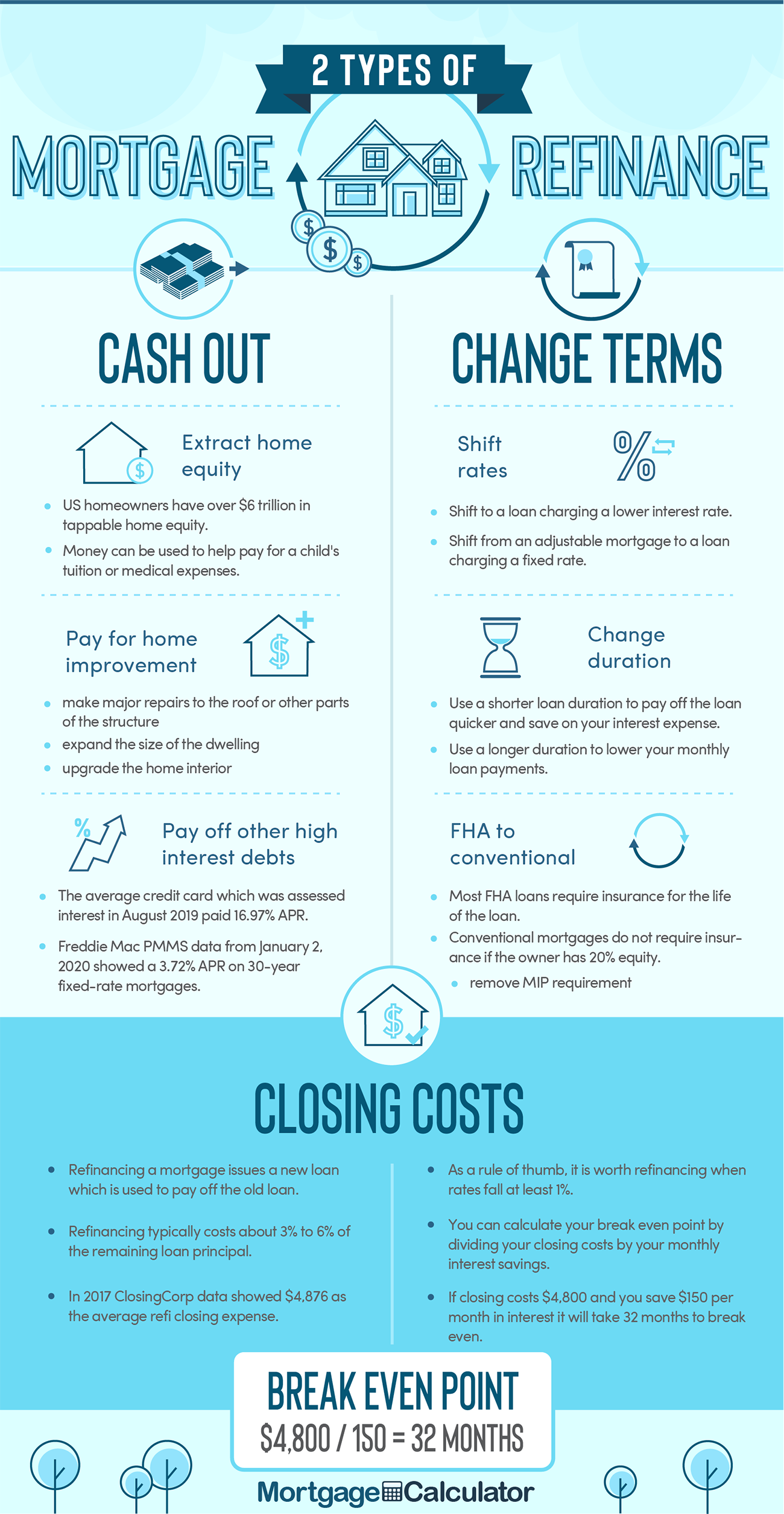

Should You Consider Refinancing Your Home?

As a general rule of thumb it is worth refinancing if rates fall at least a percent below what you currently pay and you know you are going to live in the home for at least 5 years before moving, selling it, or refinancing again.

Refinancing a home creates a new loan which pays off the old loan. A typical refinance can cost from 3% to 6% of the loan principal. In 2017 ClosingCorp date showed the average refi closing cost to be $4,876.

You can calculate your break even point on refinancing by dividing the closing costs by your monthly interest savings.

A one percent rate decline on a $300,000 loan would save around $2,000 in interest per year.

Some homeowners also choose to refinance not only based on trying to save on interest, but also to cash equity out of their homes. Refinance rates are significantly lower than the rates charged on home equity lines of credit and home equity loans.

Eventually central bank easing and fiscal stimulus will turn financial markets higher and lift inflation expectations, though nobody knows precisely when that will happen.

Which Loan Duration Should I Choose?

Please note that if you reset the term of your loan to a significantly longer duration than what you have remaining on your current loan then you will likely pay more interest over the life of the loan even if your monthly payment falls.

Shorter duration loans typically charge lower interest rates. When you refinance you can lower your total interest expense by ensuring you take out a 10-year, 15-year, 20-year, or 25-year loan which roughly matches the duration left on your current loan instead of refinancing with a new 30-year loan.

While the 30-year mortgage dominates the home purchase market, many homeowners choose to refinance using a 15-year term so they do not reset the clock on their loan and stretch out payments.

The HEROES Act

The HEROES Act established the Emergency Rental Assistance Act and Rental Market Stabilization Act, a $100 billion fund for rental assistance. It also extended the 120-day non-payment eviction moratorium from the CARES Act to a 12-month moratorium. The HEROES Act also created a $75 billion Homeowner Assistance Fund to help homeowners cover property taxes, mortgage payments & utility payments.

The NLIHC covered the HEROES Act provisions in more detail.

The HEROES Act also directed the Federal Reserve to establish an emergency lending facility to residential rental property owners.

Record Year For Mortgage Originations

Urban flight has been caused by the combination of:

- lockdowns taking away many of the entertainment or cultural venues which made higher urban rents worth it

- protests driving safety concerns

- work-from-home requiring more space at home to concentrate & no longer requiring the high rents of a big city where the worker was employed

When the urban flight was coupled with historically low interest rates that has led to what is likely to be a record year for mortgages in 2020 with Fannie Mae suggesting total loan originations will be roughly $4.1 trillion, with refinancing accounting for $2.6 trillion of activity and $1.5 trillion in purchase activity.

Low interest rates and urban flight caused the National Association of Home Builders/Wells Fargo Market Index to reach a record high of 85 in October.

GSE Adverse Market Conditions Fee

Fannie Mae & Freddie Mac announced a 0.5% fee added to home refinancing to account for adverse market conditions. This fee was initially announced in August 12th with intent to begin on September 1, but the fee was later moved to December 1.

This fee should add around $1,400 in costs to the average mortgage refinancing. Loans below $125,000 will not be assessed this fee.

Article Revision History

This article has been revised.

- March 29, 2020: added information about Ginnie Mae providing lenders direct support.

- April 3, 2020: added mortgage refinancing application statistics from the Mortgage Bankers Association.

- April 5, 2020: added notice about new restrictions to jumbo mortgages from Wells Fargo and a section offering a clarification on the difference between mortgage deferral and forbearance.

- April 9, 2020: added recent forbearance stats.

- April 18, 2020: added Black Knight forbearance stats.

- April 24, 2020: updated Black Knight stats.

- April 30, 2020: added reference to new record low mortgage rates based on Freddie Mac data.

- May 17, 2020: added HEROES Act coverage & the latest MBA forbearance stats.

- October 20, 2020: added adverse market conditions fee