Shop Around for a Mortgage

What a mundane and seemingly obvious piece of advice! And yet, according to the results of a recent survey by LendingTree.com, 40 percent of mortgage shoppers obtained just a single quote before settling on a mortgage. Given that the same poll established that 96% of consumers will comparison shop for most items, this is nothing short of astounding.

There are a few probable causes for this phenomenon. First of all, there is a small contingent of borrowers that either doesn’t understand that mortgage rates vary among lenders and/or mistakenly believe that rates are determined by the Federal Reserve Bank and that such variations are therefore trivial. Second, there is a factor of laziness. How else can you explain the 10% of borrowers that “admitted they had spent the same amount of time searching as it takes to brush their teeth.” There is also an aura of complexity surrounding mortgages, which spurs fatigued borrowers to simply choose any lender at arm’s reach. Finally, there is a misconception that lending standards have become so stringent that borrowers should immediately pounce on the first approval that they receive.

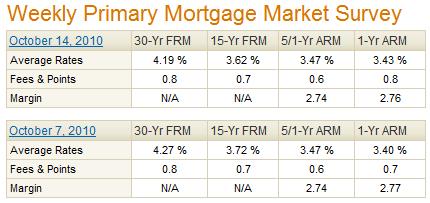

While mortgages have become a commodity product over the last decade, there is still a tremendous amount of variability between mortgage lenders, in terms of rates, points, fees, service, and lending standards. At the very least, it’s worth speaking to a few different lenders to make sure that you receive a good deal, fair terms, and good service.

The first step is to use the newspaper, internet, friend’s referrals, etc, to develop a preliminary list of 3-5 potential lenders. (You may also want to consider including a mortgage broker on the list. While this will add an extra layer of fees, a good broker will do your mortgage shopping for you and might even be able to help you save money overall). The next step is to contact each lender and ask them basic information about the types of mortgages that they offer and are potentially suitable for you. While you should focus on the financial (i.e. rates, points, fees) parameters, you should also inquire about other points of distinction. (The FTC has created an excellent table that you can use to comparison shop).

In order to give you an accurate quote, each lender will probably ask you for personal financial information. Bear in mind, however, that in order for them to offer you a precise estimate, they will need to separately pull your credit history, which could adversely affect your credit score. For that reason, it’s probably only worth obtaining a Good Faith Estimate only once you have settled on a property, and/or you know approximately how much you will need to borrow. If you elect to obtain pre-approval prior to shopping for a home, remember that you are not bound to that lender. You can always continue mortgage shopping or start afresh, after identifying the home that you wish to purchase.

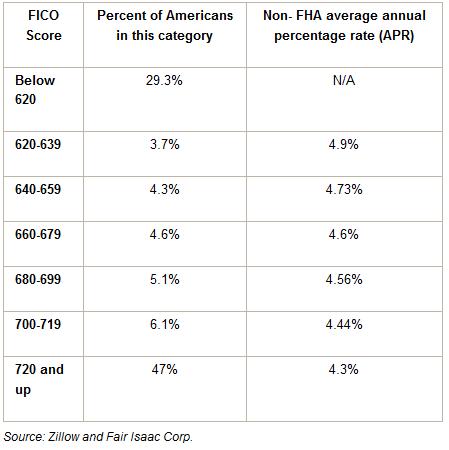

Remember that different lenders have different lending standards. Don’t be discouraged if you are rejected by the first lender(s) that you contact. Conversely, don’t automatically accept the first offer that you receive. Even if you have a mediocre credit score, you might still be able to find a handful of lenders that are willing to give you a mortgage at an attractive rate.

Finally, there is something to be said for dealing with a broker/lender that you trust. As the LendingTree survey confirmed, shopping for a mortgage is a daunting process. It might ultimately be worth paying .05% more if you feel more comfortable with one lender than another.