Walking Away: The New Calculus

If the statistics are to be believed: “strategic default” – the act of voluntarily walking away from one’s mortgage – is now becoming quite fashionable. According to the latest estimates, more than 30% of foreclosures are strategic defaults, compared to 20% in 2009. However, the calculus of “strategic default” is changing, such that you need to think twice before jettisoning your mortgage.

The debate surrounding strategic default was ignited by Brent White, a Law Professor at the University of Arizona, who suggested that breaking one’s mortgage contract was a choice like any other, and that some borrowers were acting against their best interests by continuing to pay their mortgages. White urged such borrowers to mail their keys back to their respective lender, and continue living – rent-free – in their homes until they were forcefully evicted through foreclosure.

According to White and other proponents of walking away, the only down-side of such a decision is a negative hit to your credit score. To be sure, you can expect that foreclosure will cause your FICO score to decline by 100 – 400 points, which will make securing any kind of loan in the immediate future quite difficult, to say the least. Thanks to a 2007 law enacted by Congress, you are not responsible for paying tax on a canceled mortgage, which otherwise would be treated as forgiven debt and taxed accordingly.

However, this is not the whole story. There are 11 states that have so-called non-recourse laws, which prevent lenders from laying claim to borrower assets if the proceeds from foreclosure are insufficient to repay the mortgage: Alaska, Arizona, California, Iowa, Minnesota, Montana, North Carolina, North Dakota, Oregon, Washington, and Wisconsin. That means that there are 39 states which the lender can effectively go after you for the difference, by garnishing your wages, freezing your liquid assets, or obtaining a lien on other hard assets. In addition, the lender has up to 7 years to seek such restitution, which means that you can only really escape the lender through bankruptcy.

Finally, there is the matter of securing a new place to live. Even ignoring your beaten-down credit score, the stain of credit default will prevent you from obtaining a mortgage for 5-7 years, thanks to a recent rule imposed by Fannie Mae and Freddie Mac. Buying and Bailing – in which you attempt to secure a new mortgage on a new home, before dumping your existing one – is now quite difficult, again thanks to increase vigilance by Fannie and Freddie, as well as a more stringent guidelines for mortgage lending. The only realistic alternative, then, is to rent….that is if you can find a landlord who is amenable to your financial situation.

In short, I would like to clarify my position regarding strategic default: you should only do so if you live in one of the 11 states listed above and if you are sure about your ability to secure a new place to live following foreclosure. You are also advised to speak to an attorney in order to fully understand your liability. Of course, if all things considered, it’s in your best interest to strategically default, then by all means, go right ahead.

Housing Market Remains Weak

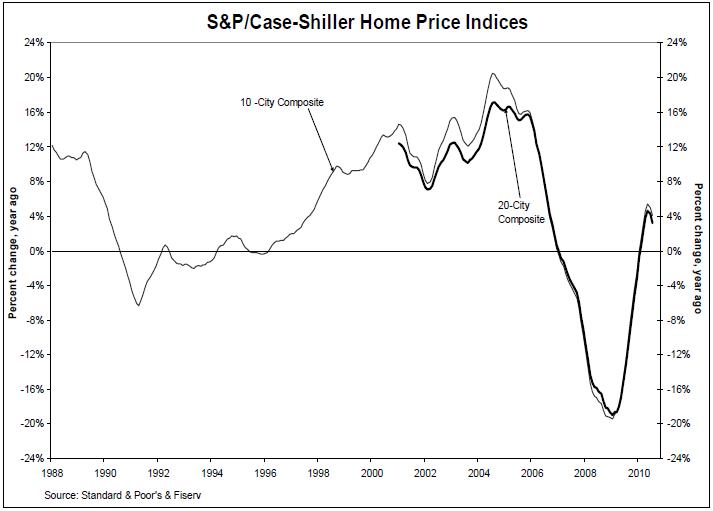

Last week, I reported that mortgage rates have declined to another record low. Unfortunately for the housing market, the resulting uptick in mortgage activity was dominated by refinancings, and there is little evidence that low rates are spurring new borrowers. This is confirmed by the updated S&P Case Shiller Index, which shows that while prices are still rising on average, they are rising at a slower rate than before and appreciation could soon turn negative.

Morgan Stanley may speak for everybody; “It expects 2011 home prices to fall 5% to 10% from this year with four years of flat prices after that, although ‘the risk of slight additional downside in prices, and extension of the trough to 2012, has increased.’ ” Most of the government home-buying incentives have expired and lending standards have tightened. If the government doesn’t continue to support the mortgage industry, declines could be even more significant.

The biggest variable is the ongoing foreclosure scandal, in which lenders have conceded to fraudulently processing foreclosures for tens of thousands of borrowers. As a result, foreclosure listings have been pulled until the investigation is resolved. Most analysts have argued that this will be roundly negative for the housing market, especially in depressed areas were foreclosure sales represented the brunt of buying and selling: “These delays ‘are just going to cause more chaos and confusion. At this point, this is probably the nail in the coffin for housing. I think worse times are still ahead of us.’ ” As a result, the shadow inventory of foreclosures will be unable to clear, and prices continue to fall.

While I think this is a reasonable argument, I think the opposite interpretation is also justifiable. Think about it- if the foreclosure probe causes the housing supply to shrink, should that shift the balance back in favor of sellers. Of course you could argue that the shadow housing inventory will continue to exist, or that buyers who would have foreclosed properties now won’t buy anything, or that lenders will be stuck with these properties on their books and will cut down on new lending to compensate. Still, the shrinking of supply should have at least a temporary stabilizing effect on the market. Incidentally, Shaun Donovan, head of the Department of Housing and Urban Development (HUD) has sided with the majority in this debate: “A national, blanket moratorium on all foreclosure sales would do far more harm than good — hurting homeowners and homebuyers alike.”

If you’re in the market for a home, you should probably stay away from foreclosed properties for the time being, due to uncertainties over title. Otherwise, remember that there is not one national housing market but hundreds of regional markets. Each of these markets has its own nuances, and may be governed by different trends and demographics. Some markets remain depressed, while other markets have barely suffered. [For value shoppers, Coldwell Banker compiled rankings of the most/least affordable markets]. Finally, consider that it’s still a buyers’ market and that there is certainly no rush to buy. If historic trends are any indication, prices will decline slightly as we move towards winter, a period when the market usually slows down.

Update: the above link to hlr.coldwellbanker.com went offline, so I updated it to reference the current file location.

Mortgage Rates Decline To Record Lows…Again

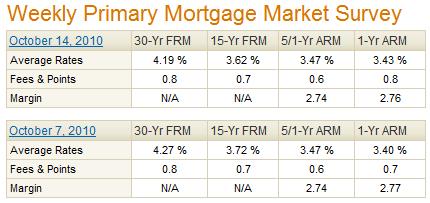

Why do I feel a sense of Deja Vu every time I write a post on this topic? Maybe because mortgage rates have been in a state of free-fall for the last year, and every week seems to offer the same story of new record lows. This week was no exception, as Freddie Mac reported that the average 30-year fixed rate is now at 4.19% and the average 15-year fixed rate was 3.62%. Both rates have declined nearly 20 basis points over the last month.

Interestingly, points (which are paid upfront and used to buy down the mortgage rate) have been rising, from .6 earlier this year to .8 today. That implies that the actual decline in interest rates is less than Freddie Mac would have you believe. It’s interesting that while lenders are willing to pass along low rates to borrowers, they are taking a larger cut for themselves in the form of points. In practice, this means that your APR will be higher than the mortgage rate quoted to you be your lender.

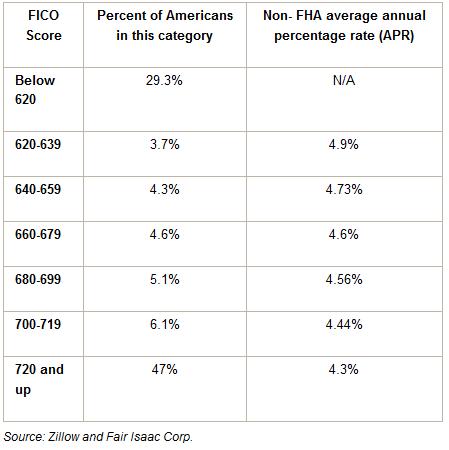

Furthermore, the lowest rates are only available to the most creditworthy borrowers. Those with FICO credit scores of 720 or above can expect to pay around 4.3%, according to a Zillow survey of mortgage data. That’s great for the 47% of borrowers that fall into this category, but what about everyone else? As you would expect, (prime) borrowers with even slightly lower credit scores are offered interest rates that are more than .5% higher than their 720+ counterparts. Unfortunately, those with scores below 620 probably won’t even receive an offer. Regardless of how you slice the data, however, rates are extremely low across the board.

One columnist recently wondered aloud whether they could fall even lower, perhaps all the way to 0%. It seems impossible, but then again no one thought that rates would be this low only a couple years after the housing bubble burst. She speculated that, “Rates at or near 0% could bring more first-time home buyers out of hiding to seek out extremely favorable financing for a house.” Even ignoring the fact that no sane lender would ever offer 0% mortgage financing, it seems unlikely that a significant number of potential borrowers are still biding their time in anticipation of still-lower rates, given that government home-buying incentives have expired and lending standards are being tightened. Already, 80% of mortgages are actually refinancings of existing mortgages. If rates decline further, it seems like it will only a trigger a new round of refinancing (as those who refinanced at 5% repeat the process).

At this point, I don’t really think it’s a meaningful exercise to ponder whether rates will fall farther. If you asked me for my honest opinion, I would say that an expansion of the Federal Reserve Bank’s Quantitative Easing program (in the form of additional purchases of Mortgage-Backed Securities) could drive rates even lower. Still, you have to wonder how much it would matter if rates fell to 3.5%, for example. For the purchase of a $200,000 home, this would lower one’s monthly mortgage payment by about $100. Don’t get me wrong- one would certainly be grateful for the savings, but for the majority of people, it wouldn’t be enough to make an otherwise unaffordable mortgage affordable.

As for how lower rates are affecting the housing market and housing prices, that’s the topic of my next post.

Interview with Dr. Housing Bubble: “You shouldn’t take on a mortgage that is 3 times your annual household income.”

Today we bring you an interview with Dr. Housing Bubble, whose blog promises to take a critical look at the policies that have created one of the largest asset bubbles ever known to mankind and whose mission is to provide a candid account of what is going on in today’s housing market. Below, Dr. Housing Bubble expounds upon the housing bust and the potential for recovery.

How to Price a Home in the Current Market

The current housing market is downright murky. Every day brings new pundits wielding new statistics and new predictions. Some insist that the housing market has bottomed, while others argue that it could fall further. Worst of all, both sides doggedly believe that they are unassailably correct. Even worse is that this same argument appears to be unfolding on the ground level: buyers insist that their homes are fairly priced, while sellers wait patiently for prices to fall further. In this kind of climate, how is one to determine a fair price?

For the record, it is clearly a buyers’ market: “There are now so many homes for sale, and so few of them are selling that, at the current sales pace, it would take over a year to clear the existing inventory on the U.S. market. That is more than double the time required in a healthy market and up significantly just since June.” In other words, buyers can afford to be selective, and can afford to declare a target price and stick to it. As a result, buyers are finding that in order to even receive an offer, they must reduce their expectations significantly: “Almost a quarter of all listings on the market at the beginning of July had at least one price reduction. The average discount from the original listing price? Ten percent, according to Trulia.com.” (quote via cnbc.com/id/38642589)

The best indication of what a home will fetch has been and will continue to be is a comparative market analysis. This kind of analysis is exactly as it seems: a real estate agent or appraiser will look at what similar homes in the same region are selling for and establish a price range. The relative size, condition, amenities, etc. of your (target) home will dictate whether it falls closer to the high end or the low end of the scale. It’s worth noting that short sales and foreclosures will usually be priced at a slight discount.

From the seller’s perspective, where you price your home depends on how eager you are to sell it. You should understand that potential buyers probably has other options, and unless you can match their patience, you might have to cut the sale price. Experts recommend that you make one big cut rather than several smaller cuts, as this will show buyers that you are sincerely interested in selling the home. If price cuts don’t work, you can also try selling the house through an auction, which will expedite the process significantly, involving a few open houses and one 30-minute auction. The offer is binding, and you can expect to have the cash in hand in a month or two. Auctions are also attractive to buyers because of the mindset that, “We don’t want to wait around or negotiate and, more important, we want to pay the price we want to pay.”

Otherwise, you might have to take the home off the market and try selling it again after the market has had more of a chance to settle. In the mean-time, you can consider refinancing any mortgage debt (to take advantage of record low mortgage rates) and renting out the home.

Auction sales were booming even at the height of the housing market, says Chris Longly, deputy executive director of NAA. He attributes some of the uptick to the popularity of sites like eBay. “Consumers today want it now,” he says. “We don’t want to wait around or negotiate and, more important, we want to pay the price we want to pay.”

Down-Payment: 20% is the Benchmark

One of the aspects of mortgage lending that has changed the most in the wake of the housing bust is the down-payment. At the height of the boom, it looked like down-payments could soon become, well, if not extinct, than at least irrelevant. Nowadays, a sizable down-payment is not only essential to getting a loan with good terms, but also to getting approved for the loan in the first place.

The current benchmark for down-payment is 20% LTV. That means you are expected to pay 20% of the price of the property in cash, with the mortgage covering the remaining 80%. For those of you who can afford to make such a down-payment, statistics show that you will be comparatively likely to repay your mortgage. Thus, you can expect to receive extremely favorable terms on your mortgage.

The primary source of funds for this down-payment will probably be your own savings account. In some cases, you can also pledge securities (stocks, bonds, etc.) and the land that the property occupies assuming that you already own it. Lenders will also allow you to borrow against your retirement account (though in some cases this must first be approved by the administrator of your IRA) as well as to contribute gifted funds from family/friends, as long as the giver signs an affidavit pledging that the gift is not actually a loan.

If the target property was appraised for more than the purchase price, however, you cannot contribute the difference towards the down-payment, even though it is arguably equivalent to home equity. The only exception is if the seller is willing to raise the purchase price and contribute (most of) the difference to your down-payment for the loan. Such is perfectly legal and is known as a Seller-Assisted Down Payment. Bear in mind, however, that if the purchase price is raised to the point that it exceeds the appraised value of the property, this kind of arrangement will probably be rejected by your lender.

If you can afford to do so, you should consider making an even larger down-payment. Some lenders will compensate you by offering you an even more attractive mortgage rate. In addition, a larger down-payment combined with a shorter duration (i.e. 20 years instead of 30 years), would enable you to own your home in a shorter amount of time and save you money in the process (in the form of unpaid interest), all without affecting your monthly payment. If instead you were to continue to prefer a long-duration (30 years) mortgage, you can count on both a lower monthly payment and aggregate savings over the life of the mortgage.

For those borrowers that can’t afford – or simply don’t want – to make a 20% down-payment, you have a few options. First, you can apply to a Down Payment Assistance Program (DPAP); it’s advisable to ask your lender for advice, rather than solicit help on your own. If you’re eligible, you can consider a Veterans Administration (VA) loan, most of which don’t require down-payments. FHA Loans are also insured by (but not originated by) the government, and hence, require only 3.5% down-payments. This is offset by a more expensive loan, however, in the form a mortgage insurance premium, payable to the FHA to compensate for the increased likelihood of default.

For everyone else, you can expect to pay a hefty Private Mortgage Insurance (PMI) premium. Assuming your lender is still willing to underwrite your loan, despite a down payment that is below 20%, you will pay both an upfront PMI premium and an annual premium, until your home equity reaches 20% LTV. [Your home equity will gradually rise both as you repay the loan and if the value of the home appreciates].

Of course, the reality is slightly more nuanced. The actual importance of the down payment will depend on numerous other factors, including your credit score. In the end, you should first seek to understand the position of your lender before determining the size of the down-payment.

Loan Modification Program Yields Mixed Results

The government has just released updated “report cards” for most of the participants in its HAMP mortgage modification program, and the results are…interesting. At this point, it can be labelled neither success nor failure.

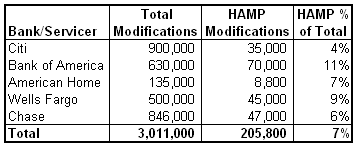

As you can see from the chart above, an impressive 3 million modifications have been completed by the country’s five largest lenders, with Citi and Chase leading the pack, and Wells Fargo and Bank of America not far behind. However, there are a couple of disappointing sub-trends buried in this figure. First of all, the vast majority of modifications have been completed privately, outside of the government’s HAMP program. Second, the majority of borrowers that receive loan modifications ultimately go on to default anyway, which means the true number of borrowers that have been helped is far below the 3 million documented by the industry.

Let’s begin with the first issue- that loan modifications have been a largely private effort. On the one hand, this could be viewed positively, since only $250 million of public money (a small fraction of the the $40 Billion that was initially allocated by the government for the program) has been spent to date. This means that borrowers are being helped without the use of taxpayer funds. On the other hand, I think the correct – albeit cynical – interpretation of this situation is that lenders are deliberately circumventing the government in order to offer their own, watered-down modifications. Think about it – why would lenders pass up “free” incentive money from the government, all else being equal? The explanation is that the government’s modification program (HAMP) offers terms that are more favorable to borrowers than lenders wish to offer.

Since I’m on the subject of HAMP, it’s worth pointing out that only 390,000 borrowers have received permanent modifications. While this is nothing to scoff at in absolute terms, it falls far short of the number of borrowers that could benefit from assistance (10 million?) and even short of the government’s projection that 3 million borrowers would receive assistance from the program. The WSJ recently mused, “So how big a flop is HAMP? Modifications still face a high re-default rate, largely because borrowers still have heavy debt loads. Some borrowers have found themselves worse off because they do everything possible to get a trial modification, only to be turned down.” Still, the author of the story conceded that at the very least, the government’s program galvanized the private sector into action.

As I alluded to above, however, a significant portion of borrowers that receive modifications will ultimately default, or have already defaulted. As you can see from the chart above, half of borrowers (regardless of the extent of the modification) will default on their new mortgages within 12 months. That makes me wonder if the lull in foreclosures we have seen in some states – which have been attributed to loan modifications and other proactive efforts by lenders – might in fact be a mirage, and could perhaps re-emerge in a year or so, after a wave of re-defaults.

While the process of obtaining a loan modification is admittedly frustrating, lenders continue to grant them en masse, namely because they have determined that it is in their financial interest to do so. Thus, if you still think you’re entitled to a modification – whether private or HAMP – you should continue to harangue your lender. If your circumstances warrant it, chances are you will be granted one eventually.

Interview with Patrick Duffy of Housing Chronicles: “Everything Eventually Reverts to the Mean.”

Today we bring you an interview with Patrick Duffy of of the Housing Chronicles Blog. Patrick is also the Founder and Managing Principal of MetroIntelligence Real Estate Advisors, as well as a former Managing Director of Consulting with Hanley Wood Market Intelligence. Below, he shares his thoughts on housing prices, loan modifications, and the pros and cons of renting, among other topics.

Interview with Raul Black of HousingCorrection.com: “The market will eventually heal itself.”

Today we bring you an interview with Raul Black of HousingCorrection.com, which contains a collection of online house valuation tools. Below, Raul shares his thoughts on housing prices, buying versus renting, and foreclosure.

Mortgage Calculator: I’d like to begin by asking you about your background. What made you decide to join the ranks of housing watchers? How would you summarize your approach to the (current) housing market, and how has your background informed this approach?

In 2005 I began searching for a house near my place of employment in order to reduce my 3-hour round-trip commute. I couldn’t help but notice everything in my region seemed overpriced. I began exploring housing data in an effort to understand why prices appeared to be unsustainably high. I wound up becoming hooked on the subject matter.

My approach to understanding the housing market is highly data-concentric, which fits well with my occupation as a data analyst. Unfortunately, data tells a large part of the story, but it doesn’t tell the entire story. If prices maintained strict relationships to popular fundamentals, we would have never had a housing bubble. Thus, I attempt to balance my data-driven approach with other techniques such as observing market psychology and using good old fashioned common sense.

Since random unforeseen future events have not been captured in my historical data sets, betting the farm on a promising historical pattern is not my goal. Instead, I attempt to assign relative probability measures to various potential outcomes and continue to adjust these forecasts as new data arrives and my understanding of the subject increases.

Mortgage Calculator: It seems both the housing bubble and its bursting have been characterized by important regional disparities, so it’s not really meaningful to make generalizations on a national basis. Do you think that the recovery, whenever it cements itself, will also adhere to this pattern? Based on the data that you diligently display on your website, are their some markets that you would avoid, but other areas that you would gravitate to?

The price of each region is a function of local, national, and global economic factors. In my opinion, global and national economic factors (such as the Fed’s open market operations) will continue to influence price, but so will each region’s individual economic situation. Thus, we’ll see general national trends accompanied by continued price disparities among regions.

Northwest cities such as Seattle, WA and Portland, OR have a high probability of continued depreciation due to prices being well out of line with historical fundamentals. Despite prices being extremely cheap by historical standards in Phoenix and Las Vegas these areas still have extremely high foreclosure heat and will most likely continue to correct. Further east, I’m negative on Chicago and New York. That’s kind of a popular forecast of the Case-Shiller 20, but it fits well with what I’m seeing.

There are areas in the U.S., such as Sioux Falls, SD and Lincoln, NE that have remained more immune to the housing bubble and the national economic downturn than others. Buying into this pattern is a safer bet than buying in cities that ran way up in price, got nailed by the economic downturn, and have yet to come back to earth.

(Cleveland appreciated 4.5% per year from 1985 to 2006, eventually giving way to a rocky local economy.

Areas, such as Cleveland, that appreciated at a steady rate over the long term and were hit by the economic downturn could be setting up for modest gains if the economy continues to improve.

Given time, bubble cities such as Vegas will look like outrageous bargains. But don’t jump too soon, or you could get burned by continued foreclosure problems.

Mortgage Calculator: What do you think it will take for people to accept the notion that home prices don’t appreciate much faster than the rate of inflation, over a long-term period of time?

I think the short answer is time. It will most likely require several years before people develop fresh memory patterns that become etched deeper than the memory of their euphoric bubble experience. In the meantime, I believe lots of people will lose their homes and their money. Losing money tends to have a sobering effect on optimistic mania.

Mortgage Calculator: HousingCorrection.com suggests that housing prices will continue to fall. Is this based on the forecasting tools available on your website, other experts, or your own intuition?

It’s based on a combination of all three factors. Using data-driven techniques, I have attempted to test a number of experts’ forecasts. In doing so, I’ve learned at least as much from others as I have from studying the data. As for intuition, I believe it can be a powerful tool when used in limited amounts. However, it’s important to not get intuition confused with emotion. In my experience, emotion-based decisions generally yield a poorer return on investment than decisions arrived at through logic and intuition.

Mortgage Calculator: The data suggests that foreclosures will continue to rise. Do you think that government programs and lender initiatives will be enough to forestall this? Do you think that strategic defaults will continue to be a factor?

I trust what the data says. Foreclosures will continue to cause distress in the market for the next several years.

The government is good at applying bandages that temporarily conceal gaping wounds, but they have little experience fixing deep underlying economic problems. A good example is May existing house sales. Most experts expected more homes to sell in May than April due to buyers having rushed to beat the tax credit deadline. But when the data came out, it showed that sales dropped. The government has a poor reputation when it comes to bang for the buck.

Bringing back high-paying jobs in this country is a much better fix for the housing market than government gimmicks aimed at propping up prices above what people can afford to pay. Our nation’s leaders have thrown a kitchen sink full of expensive gimmicks at the foreclosure problem; yet, RealtyTrac track indicates bank repossessions hit a record monthly high in May.

Knowing that the government’s ability to bring house prices back to bubble levels is severely restricted, who wouldn’t be tempted to mail their keys back to the bank if they were underwater on their home? Despite what most real estate agents claim, homes typically represent highly leveraged investments. When you gamble and win, it’s great! When you gamble and lose, you renege. The banks did it, and homeowners are doing it too. If provided a path, it’s human nature to walk away from bad deals.

Mortgage Calculator: Do you generally believe that renting is more economical (and more sensible!) than buying, even when the ratio of rent to home prices is more in line with long-term averages?

I believe different people extract different forms of value from homes. Owning a home within your financial means can provide a sense of belonging, stability, and security. However, that same home outside of your financial means becomes a nightmare. On the other hand, renting relieves occupants of numerous responsibilities and allows packing up and moving without having to pay 8% of the home price for taxes and real estate commissions.

It is up to each individual to measure the value they get out of renting the home compared to purchasing it. From a purely investment standpoint, I would be very reluctant to purchase a home in my area that is not rentable as cash-flow positive after having put 20% down. Anything outside of this range sets off warning signals for me. If a home doesn’t make financial sense to me as an investment, it doesn’t make financial sense as a personal residence.

Mortgage Calculator: How would you reconcile government and seller incentives and low interest rates with the possibility that home prices could fall further, when advising someone thinking about buying their first home? Would you advise them to buy, wait for a while, or wait forever?

Government incentives are great for house sellers but they are not always favorable to house buyers—especially when offered at the bust end of a pyramid scheme. They tend to temporarily inflate prices but, once the support is withdrawn, prices continue to correct. With seller incentives buyers pay more in order to get perks that must be paid for over the life of the loan. Low mortgage rates only make sense if you are buying in an area that has overcorrected to the point of prices being cheap by historical standards. Otherwise (barring wage inflation) when rates go up, house prices will go down so that buyers can afford the monthly payments.

It’s typically very difficult to save a down payment because rising home prices eat into the cash you save. The current environment of flat to declining home prices provides an unusually good opportunity to live frugally while saving up down payment equity. In most cases, I recommend keeping an eye on the jobs data in your area, as it is a leading indicator of where house prices are heading. While unemployment is high, saving a down payment is a much safer bet than attempting to catch a falling knife.

Ultimately, whether to buy or wait depends on your job security, the area where you live, what your specific needs are, how long you plan living in the home, your views on future inflation and the future of jobs in your region, and several other factors. If you’ve decided you need to buy a house, don’t buy the first house you see, and don’t depend on your real estate agent to be the expert. Do your own research and become informed about your specific market. In addition, it’s important to keep your impulsivity and emotions in check during the buying process.

In my opinion, the market will eventually heal itself. Increasing population growth accompanied by record low building starts will eventually improve the supply/demand ratio. It’s important to become an informed buyer in the meantime. This provides insurance against becoming one of the millions of foreclosure casualties throughout the country.

Mortgage or HELOC: Which to Pay Off?

Many of those that have an outstanding Home Equity Line of Credit (HELOC) loan are debating whether to withdraw additional funds in order to pay off their primary mortgages.

On one level, this probably seems like a silly question/notion, since it essentially involves substituting one loan for another. However, consider that HELOC loans typically accrue interest at variable rates while most primary mortgages accrue interest at a fixed rate. Those for whom such is the case can thus reap immediate savings on interest by withdrawing additional funds under their HELOC in order to repay their primary mortgage.

Of course, there are a couple problems with this approach. First of all, it ignores the possibility that variable rates may soon rise, to the extent that they exceed fixed rates. Under such a scenario, anyone who exchanged their primary mortgage for a HELOC would end up paying more interest. Second, there is a school of though which holds that a HELOC should be repaid before a primary mortgage, and in fact, this idea was confirmed by a recent study, which demonstrated that those who obtain home equity loans are more likely to default on their primary mortgages.

On the other hand, there is no indication that variable rates will rise anytime soon, let alone to the point where they would exceed fixed rates.The Fed has conveyed that rates will remain low for an extended period of time, and when it finally moves to adjust its benchmark Federal Funds Rate, it will probably move slowly. Thus, anyone who used their HELOC to repay their mortgage would probably save money for at least a couple years. Beyond that, it’s hard to predict where mortgage rates will stand.

Another approach would simply be to refinance one’s primary mortgage. While variable rates are currently near record lows, fixed rates are as well. Why risk a rise in variable rates if you can lock in a fixed-rate that as nearly as low? If, however, your credit is not strong enough to qualify for a refinancing, this is not an option. Instead, you can spend 1-2 years rebuilding your credit, before re-applying. If you are confident that you can stand the risk, you can shift the balance of your loan over to your HELOC, and save money in the interim.