Interview with William Gloede: “Government does not belong in the housing market.”

Today we bring you an interview with William Gloede of Big Builder Online. Below, Mr. Gloede shares his thoughts on the recovery in housing prices and the government’s role in the housing market.

Interview with The Mortgage Professor: “I would not buy for speculative purposes”

The Tax Consequences of Mortgage Debt Cancellation

What You Need to Know about Option ARMs

Changes to the Mortgage Tax Deduction?

Edit: the below blog post was published 7 years ago. We also recently covered the Tax Cuts and Jobs Act which goes into effect in 2018.

A new Congressional proposal would eliminate one of the distinguishing features of a (US) mortgage: the mortgage interest tax deduction. Critics of the deduction have long argued that it deprives the federal government of much-need revenue, that it contributes to home-price inflation, and that it doesn’t do much to spur home ownership. As a result, the consensus is that an alternative system needs to be legislated into existence, and it must be equitable, effective, and efficient.

Towards those ends, the Wyden-Gregg bill, which is currently working its way through the system, would either completely do away with, or scale back the deduction that many homeowners currently claim when filing their taxes. One proposal would impose a maximum income constraint of $250,000 on would-be filers, in order to address the concern that the deduction primarily benefits the wealthy. Another proposal would replace the annual tax deduction with a one-time homebuyer tax credit, amounting to perhaps $10K. Rest assured, however, since the bill doesn’t have much support – given current economic conditions – and it seems unlikely that the deduction will be phased out any time soon.

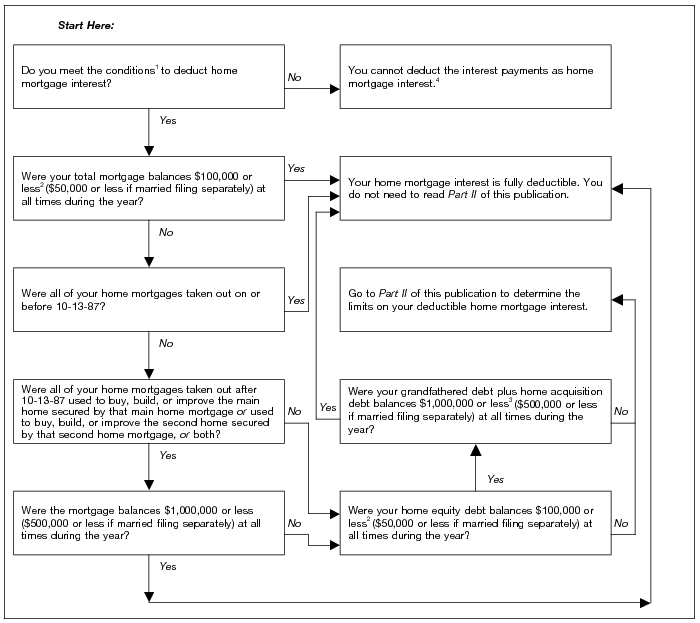

For the time being, then, you can still deduct interest on the first $1 million of mortgage debt, as well as all of your property taxes, for up to separate residences. (That’s $1 million all together, not each). In addition, you can also deduct interest costs on up to $100,000 for a home equity line of credit. For now, you can also deduct private mortgage insurance (PMI), but only if you bought your house in 2007 or later. Property taxes – but not homeowners insurance – are also deductible. As with any aspect of the tax code, the mortgage interest tax deduction is much more complicated than you think, and there are a handful of conditions that must be met before you can claim it. The most important one is that you itemize when filing your taxes. For more information, refer to the IRS website, and review the flowchart below.

If you are in the process of buying a home (and obtaining a mortgage), you can use our Real Estate Tax Benefits Calculator to estimate the savings associated with deducting your mortgage interest. Basically, the calculator will multiply your marginal tax rate by your estimated annual mortgage interest (as well as PMI and property taxes) to determine how much you will save as a result of the deduction. Given the uncertainty surrounding this perk, however, you would be wise to treat the savings as a gift, and not try to apply all of it towards a more expensive mortgage.

How Much Can you Borrow?

As the name of our website implies (and as the #1 Google ranking confirms), we are THE online source of mortgage calculators. Unfortunately, there isn’t enough space in this post to explore all 22 of our mortgage calculator tools, so I’ll focus on one in particular: Home Affordability Calculator.

The purpose of this calculator is to help you figure out the maximum that you can borrow, under a given set of loan parameters. Many borrowers begin the process by trying to find the home of their dreams, and then worrying about if/how they will afford to repay the mortgage associated with it. A better (or at least more conservative) approach, would be to begin by using the Home Affordability Calculator to determine a reasonable borrowing amount, and then go out and look for a home.

The first input in the calculator is your estimated down-payment. If you already have an idea as to a down-payment (which will come from your savings, and not from the loan), you can key it in here. For those of you just beginning the process, you probably won’t have a strong idea of what kind of down-payment will be expected of you. For a conventional mortgage, 20-25% is the standard, while FHA loans typically require only 3.5-5%.

Next, estimate your interest rate. Again, for those just starting out, this will probably be impossible, especially if you aren’t even aware of prevailing market rates. You can find information on regional interest rate levels from the weekly Freddie Mac Primary Mortgage Market Survey. Given that interest rates fluctuate over time and that you may have to pay a higher rate if your credit isn’t perfect, it’s a good idea to be conservative when estimating your rate, perhaps by adding .5% onto an “average” rate [Note: it is assumed that points, which are used to “buy down” the interest rate will come out of your pocket, and hence are not included in the calculation. The same is true for closing costs. Some loans allow you to finance your points, but that is beyond the scope of this calculator].

Length refers to the duration of your mortgage. 30 years is standard, although 15 years is also an option. Estimated front ratio refers to the percentage of your gross (after-tax) income that your PITI (mortgage principal, interest, taxes, and insurance) will represent. The estimated back ratio refers to the percentage of gross income that all of your debt (mortgage, auto loans, credit cards, etc.) represents. Unless you have reason to believe otherwise, you can assume a 28/36 (front/back) ratio, which means that your PITI cannot exceed 28% of your gross income, and all debt (including PITI) cannot exceed 36% of income.

The next step is to enter all of your gross (after-tax) income into the income fields. You should include the income for all parties who will be listed on the loan documentation. The same goes for the debt fields. [Note that you cannot exclude the debt of one of the parties without also excluding his/her income]. This data will be used in conjunction with the ratios to determine how much you are ultimately eligible to borrow, so it’s important to be accurate and truthful.

Then, enter in estimated property taxes (usually expressed as a percentage), as well as homeowner’s insurance, and private mortgage insurance (PMI) which is paid both upfront and annually by high risk-borrowers (i.e. those whose down-payments are less than 20%) to mitigate against the risk of default. If your projected down-payment exceeds 20%, you can leave this field blank.

Finally, click the calculate button, and you will be provided with the maximum that you will be allowed to borrow under the parameters you entered. You can play around with the loan parameters (i.e. increase the down-payment size, change the loan term) and watch the results change accordingly.

It is important to remember that this represents an estimate only. When it actually comes time to obtain your loan, most of the inputs will probably be different from what you originally assumed, so it’s important to be conservative. Last, this formula is designed to show how much you are eligible (the maximum that the bank will lend you) to borrow, and not necessarily what you can afford to borrow. If the housing bust has taught us anything, it is that the gap between these two figures is often larger than most borrowers initially estimated. Plan accordingly, and be conservative!

Interview with Dan Green: “You can plan for risk if you know it exists”

Today, we’re proud to bring you an interview with Dan Green, a loan officer who worked for Waterstone Mortgage in Cincinnati and was the author of The Mortgage Reports. He has since moved on to writing for Growella & recently asked us to update his attribution link to his new publication.

Strategic Default: The Next Chapter

Previously a fringe issue, strategic default is expected to take center stage of the foreclosure “epidemic” that continues to sweep the country. This is due to two primary factors:

The first is that more than 20 million mortgages will soon be underwater (the mortgage exceeds the current market price of the home); that’s 25% of the total. More worrisome is that 5 million of these will be underwater by more than 25%, which is a “critical” threshold as determined by analysts. Of course, there is a certain arbitrariness to this threshold, but the idea behind it is that at a certain point, the idea of owing more than your home is worth takes on a real significance as parity in the near-term becomes less of a hope and more of a dream.

Even assuming that starting today, home prices will start appreciating by 5% per year, that means it will be five whole years (10 for a borrower that made a 25% down-payment) before a borrower that is 25% underwater can get back to the starting point of the mortgage. When you consider that underwater borrowers are predominantly located in markets that also experienced the largest bubbles (i.e. Nevada, Florida, Arizona), even assuming 3% a year looks generous at that point. When you further consider that some of those borrowers are more than 50% underwater, the idea of waiting 20 years before they can get back to even can seem sisyphean. Purely in terms of the numbers, then, there is already a critical mass of borrowers for whom strategic default will be attractive.

The second factor driving strategic default is increasing attention by the (mainstream) media, which appears largely indifferent – sometimes cautiously supportive – of strategic default. At the beginning of the credit crisis, when default was seen as “legitimate” (there was no way many of those borrowers could make good on their mortgages under current circumstances), nobody made much attention to strategic default. Those that noticed it thought of it as “baffling” (in the words of Wachovia), and a handful of columnists ventured to call it irresponsible.

Since the release of the University of Arizona Professor Brent White’s paper on the subject, strategic foreclosure has gradually gained mainstream acceptance. Professor White examined the issue from the legal perspective, noting that contracts are frequently broken when one of the parties determines that it’s in his best interest (i.e. the benefits outweigh the costs) to do so. Public opinion, meanwhile, has focused more on the comparison with Wall Street, which behaved irresponsibly during the years leading up to the credit crisis, only to avoid collapse by being out by the government. To hold borrowers up to a higher standard, goes the argument, seems unfair.

As I have argued in previous posts on the subject, for many people, it would indeed seem that the financial benefits outweigh the costs. In states where non-recourse loans are mandated, lenders are entitled to the home and nothing else in the event of foreclosure. In the majority of states, recourse loans are the norm, which means that a lender can technically sue for the difference in the event that a foreclosure sale turns up less than the value of the loan- though few lenders actually bother doing so. In addition, there are no tax consequences for the majority of defaulters, thanks to the Mortgage Forgiveness Debt Relief Act of 2007, which “applies to debt forgiven in calendar years 2007 through 2012. Up to $2 million of forgiven debt is eligible for this exclusion ($1 million if married filing separately).” The only costs then are those associated with moving, and the inability to borrow for the next few years due to a flattened credit score. For many defaulters, these costs pale in comparison to the immediate savings from renting a comparable property rather than making mortgage payments.

The main argument against foreclosure continues to be a moral one. But even this is somewhat flimsy, when you consider that the possibility of default is an inherent feature of mortgages (that’s why borrowers have to pay interest!). This is especially the case with non-recourse loans, where a study recently determined that borrowers unwittingly pay lenders an extra $800, when compared to recourse loans. In these states, then, strategic defaulters can perhaps rest assured that one way or another, they paid for the right to default.

Interview with Interfluidity’s Steve Waldman: “The government has chronically oversubsidized mortgage lending and homeownership”

Today we bring you an interview with Steve Waldman of Interfluidity. I decided to focus the interview around strategic default and the ever-expanding role of the government in the housing market.

A Word of Caution about HUD 203(k) Mortgages

Not the most stimulating headline, I admit, but it’s a topic that deserves some bandwith. Let’s be honest: who out there even knows what a HUD 203(k) Mortgage is? Who’s first instinct (I’m guilty) was that it is an abstruse program that brings together 401K retirement accounts with mortgage financing? That’s what I thought.

Let’s get serious for a moment. A 203(k) is a HUD program that provides mortgage loans for the purchase of so-called “fixer-upper” properties. According to HUD, 203(k) mortgages serve a very important function because, “The purchase of a house that needs repair is often a catch-22 situation, because the bank won’t lend the money to buy the house until the repairs are complete, and the repairs can’t be done until the house has been purchased.”

Towards that end, the 203(k) allows the borrower to roll all of the costs of renovation into the mortgage. While these costs are theoretically uncapped, they must be estimated ahead of time. Further, it must be confirmed by an appraiser that the value of the home will increase at lease by these costs upon the work’s completion. In this way, those that might have otherwise been discouraged from buying dilapidated properties have an inexpensive source of financing (only 3.5% down, consistent with the FHA’s other mortgages).

There is also a new Streamlined 203(k) “Limited Repair Program, that permits homebuyers to finance an additional $35,000 into their mortgage to improve or upgrade their home before move-in. With this new product, homebuyers can quickly and easily tap into cash to pay for property repairs or improvements, such as those identified by a home inspector or FHA appraiser.”

The costs of these repairs, along with a “contingency reserve” of 10-20%, origination fees, and of course the purchase price of the property, are all rolled into the mortgage. Since it’s assumed that many of these properties won’t be of inhabitable condition until after the repairs are completed, the borrower also has the option of rolling 6 months of pre-payments (PITI) into the mortgage as well. Upon closing of the mortgage, the repair costs are deposited into an escrow. Withdrawing these funds can be tricky, however.

While FHA loans are effectively guaranteed by the government, they are originated and administered by private lenders. As one couple’s story illustrates, dealing with one’s lender is not always straightforward when it comes to the 203(k):

“As the contractors were hungry for work, we got started improving the property right away,” she said. “We had been told by our mortgage broker that we could expect the first draw against our $35,000 escrow 15 days after closing.”

As time passed, however, “we heard nothing from Bank of America, other then where to send our first mortgage payment,” she said.

For three months, the couple paid their mortgage, yet received no check for the work done so the contractors could be paid.

To pay for the work, “we have had to empty our savings and run up our credit cards,” she said. “We finally asked them to stop until we can find resolution with Bank of America.”

Unfortunately, borrowers who get the run-around from their lenders unfortunately don’t have much recourse, and can’t expect any help from the government. The best advice, then, is to make sure that the escrow is available to you start shelling out money for repairs. In fact, the raison d’etre of the 203(k) is to prevent the borrower from having to pay for repairs out of his own pocket. In hindsight, this couple would have been wise to heed this advice.